Are you a student in college, or an educator who teaches?

Here’s some things you may not have known about education/teaching and taxes.

🐝Educators and teachers get a special tax deduction

Eligible educators can deduct up to $300 ($600 if married filing jointly and both spouses are eligible educators, but not more than $300 each) of unreimbursed trade or business expenses. This tax deduction lowers the amount of income considered taxable. An eligible educator includes any K-12 teacher, instructor, counselor, principal or aide for at least 900 hours a school year in a school that provides elementary or secondary education. For further IRS guidance, visit IRS Topic 458.

🐝Those making student loan payments can deduct the interest paid

Individuals making payments on student loans can deduct the interest they paid from those loans on their tax return. For interest payments over $600 during the year, the individual will receive a Form 1098-E (Student Loan Interest Statement). The interest paid during the year may qualify for a tax deduction, lowering the amount of income considered taxable. For further IRS guidance, visit IRS Topic 456.

🐝College students will receive a Form 1098-T for their taxes

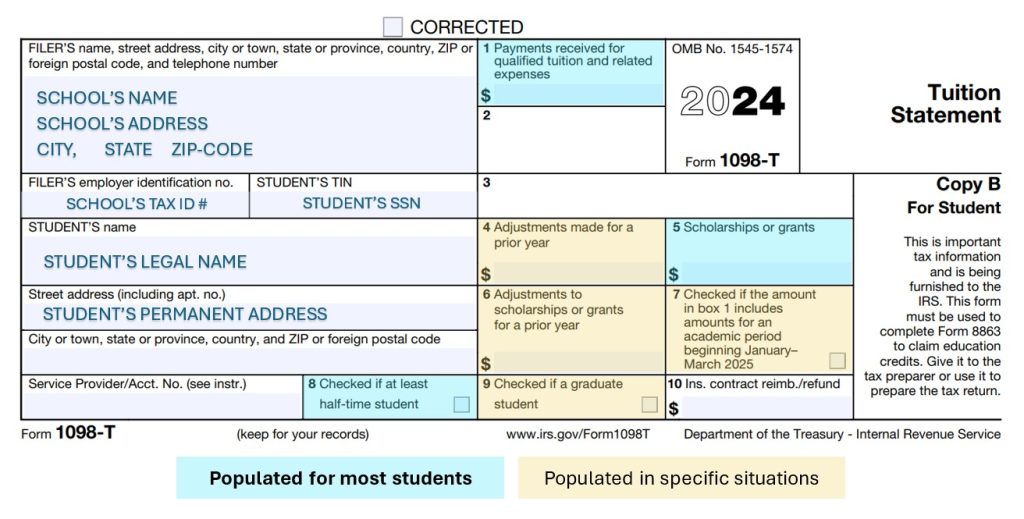

Individuals who enroll at an educational institution will receive a Form 1098-T (see image). This tax document shows the amount of tuition paid to the university during the course of the year (box 1), as well as the amount of scholarships or grants reported to the school (box 5). Down below, box 8 denotes if the student was at least a half-time student. This is important to determine dependency status and some tax credits.

Students can typically find this form in late January or early February in their finance or tax center on the school’s student portal. The IRS also receives a copy of this document.

The parent of a student may claim these credit if they claim the student on their tax return. If the student files a tax return, they must denote on their tax return that they can be claimed as a dependent on another return. If the parent does not claim the student, the student may claim these credits.

How does this 1098-T form impact my taxes?

If Box 1 (tuition received) is GREATER THAN Box 5 (scholarships), the student may qualify for a tax credit, since not all of the tuition was covered by scholarships or grants. These credits include the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC). If scholarships is greater than the tuition received, the remainder is categorized as other income and is subject to tax.

American Opportunity Credit

The American Opportunity Tax Credit (AOTC) is a maximum of $2,500 per student, based on a maximum of $4,000 of qualifying expenses paid during the year. The credit equals 100% of the first $2,000 of expenses plus 25% of the next $2,000 of expenses. The credit is split in two parts. 60% is nonrefundable (goes to lower any tax, will not show in refund amount). The remaining 40% is refundable (goes to lower any tax AND you get the remainder in your refund).

Students must meet all of the following: (1) this credit has not been applied on behalf of this student for any 4 prior tax years, (2) the student has not completed the first 4 years of postsecondary education, (3) was enrolled at least half-time for one academic period, and (4) had not been previously convicted of a felony for possessing or distributing a controlled substance. The student does not qualify for AOTC if any of the four criteria are unmet.

For the AOTC, expenses such as textbooks, technology, notebooks, pens/paper, or other school/lab/classroom supplies that were not required by the school and paid for by the student are not included in Box 1, but can be added on the tax return to increase the amount of qualified school expenses. Expenses such as room and board, health fees, insurance, transportation, and personal expenses are NOT considered qualifying education expenses—do NOT include these!

Lifetime Learning Credit

The Lifetime Learning Credit (LLC) may be an option for student who do not qualify for the AOTC. The LLC is a maximum of $10,000 of qualified expenses paid in the tax year including ALL eligible students on the return. This credit equals 20% of the combined total of expenses, allowing a maximum credit of $2,000 per return. This credit is nonrefundable, meaning the amount of the credit goes toward lowering any tax you owe, but any leftover amount is NOT refunded back to you and is NOT included in your refund. To qualify for the LLC, students must meet all of the following: (1) enrolled in one or more courses at an eligible educational institution, and (2) student is taking course for post-secondary education or to improve job skills. There is no limit on the number of years you may claim the Lifetime Learning Credit.

For the Lifetime Learning Credit, the ONLY qualifying expenses that can be added to Box 1 (tuition and school expenses) include the tuition and fees required for enrollment or attendance, including amounts required to be paid to the institution for course-related books, supplies, and equipment. For example, for the LLC, if you had to buy a textbook from Amazon, that does NOT qualify as an expense (whereas it WOULD for the AOTC).

🐝Qualified Tuition Plans (QTPs), Education Savings Accounts (ESAs) and 529 Plans

Individuals can set up special accounts to help pay the qualified education expenses for a designated beneficiary. Examples include education savings accounts (e.g. Coverdell ESA) and qualified tuition plans (e.g. QTP or 529 plan, Florida Prepaid). When a distribution is paid out, the student or designated beneficiary may receive a Form 1099-Q.

The rules for contribution limits and beneficiary payments varies depending on the type of education plan. Distributions from these plans are categorized as either tax-free or taxable. Generally, this depends on whether the distributions are equal to or less than the adjusted qualified education expenses (AQEE). Determine the AQEE by subtracting tax-free educational assistance/scholarships from the total amount of qualified education expenses. For further IRS guidance, visit IRS Publication 970.

Another great resource is this link, which is a presentation from the IRS on how to figure the 1099-Q into your tax return.

View the image to the left from Ramsey Solutions to learn more about the differences between ESAs and QTP/529s.

🐝If I claim my child who is a student, who claims the credit?

If parents are claiming their child who is age 18-24 and is at least a half-time student in school, the parents would claim the 1098-T and/or 1099-Q on their tax return. If the student must file a tax return, the student must notate on their return that they can be claimed as a dependent on another return.

The student would only claim the 1098-T and 1099-Q if their parents are not claiming them on their return.

🐝Have more questions, or ready to file?

Schedule an appointment or send us a message! Visit the Contact Us ✉️ tab for our email and phone number.

We offer in-person, virtual, or drop-off services—whichever works best for you.